Solutions of this type automate and streamline the process of dividing a building’s construction or renovation costs into different asset classes for tax depreciation purposes. These tools leverage data analytics and sometimes... Read more »

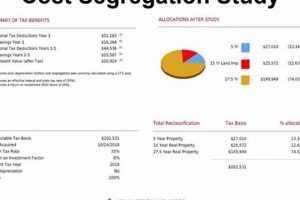

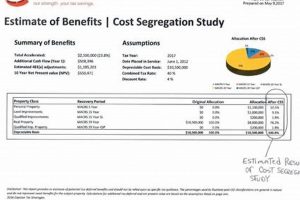

A demonstrable analysis dividing building expenses into distinct categories for tax depreciation purposes provides a comprehensive illustration of how such a study is executed. This illustration might detail a hypothetical commercial property,... Read more »

A detailed illustration of a property assessment process designed to reclassify building components for tax depreciation purposes can significantly impact a taxpayer’s financial obligations. For instance, consider a newly constructed office building.... Read more »